The IRS issued guidance clarifying the electric vehicle tax credit rules outlined by the Inflation Reduction Act, which was signed into law on Tuesday.

Here are edited excerpts.

EVs purchased before Aug. 16

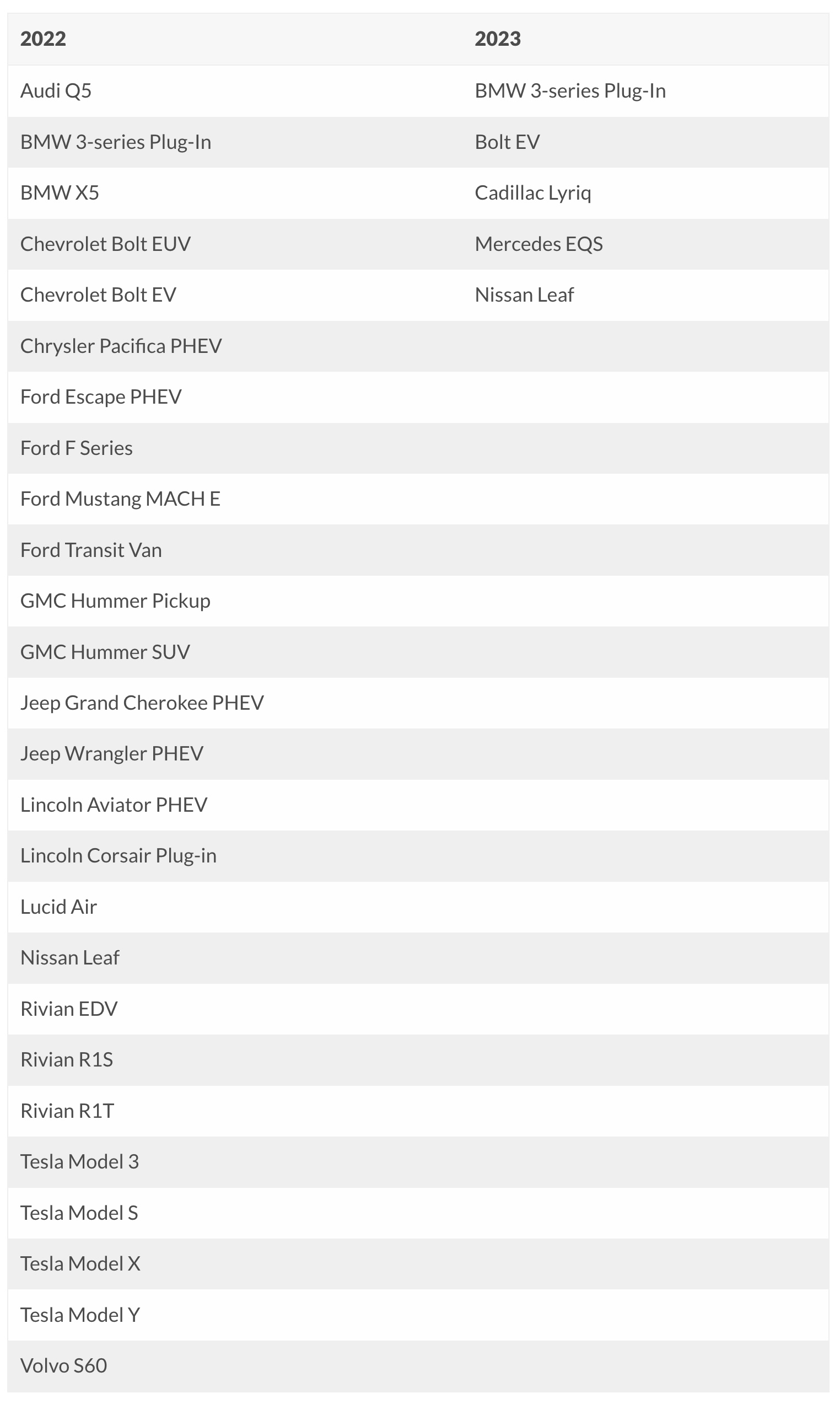

» If you entered into a written binding contract to purchase a new qualifying electric vehicle before Aug. 16, but do not take possession of the vehicle until on or after Aug. 16 (for example, because the vehicle has not been delivered), you may claim the EV credit based on the rules that were in effect before August 16. The final assembly requirement does not apply before August 16.

EVs purchased and delivered Aug. 16-Dec. 31

» If you purchase and take possession of a qualifying EV after Aug. 16 and before Jan. 1, aside from the final assembly requirement, the rules in effect before the enactment of the Inflation Reduction Act for the EV credit apply (including those involving the manufacturing caps on vehicles sold). If you entered into a written binding contract to purchase a new qualifying vehicle before Aug. 16, 2022, see the rule above.

Read Article