After a decline in overall satisfaction in 2024, owners of both premium and mass market battery electric vehicles (BEVs) are expressing a change of sentiment this year, according to the J.D. Power 2025 U.S. Electric Vehicle Experience (EVX) Ownership Study,SM released today. Notable, too, is that year-end retail sales data from J.D. Power shows that BEVs reached a market share of 9.1% in 2024, up from 8.4% in 2023, fueled in part by a growing number of mass market BEV models entering the market.

This comes as uncertainty surrounds the EV landscape, given the current presidential administration’s signal to eliminate or reduce EV tax incentives and public charging infrastructure funding. Notably, updates to the Inflation Reduction Act more than doubled the amount of owners who indicated they received a federal tax credit/rebate, and more than half of BEV buyers cited tax credits as a reason for purchasing their vehicle, which is among the most influential purchase drivers. As a result, J.D. Power is forecasting EV share of retail sales to remain flat in 2025.

“The elimination of EV tax incentives and public charging funding has the potential to affect two critical barriers to EV adoption: public charging availability and vehicle prices,” said Brent Gruber, executive director of the EV practice at J.D. Power. “This temporary slowdown in market share growth for EVs creates a unique challenge for the industry as manufacturers forge ahead with new vehicle introductions. The EV market will be faced with expanded product offerings and flat share, creating increased competition.”

Following are some key findings of the 2025 study:

Opportunity to improve BEV ownership experience via customer education: In this year’s study, owners were asked if their dealership or manufacturer staff provided any specific education or training on aspects of EV ownership during the purchase process. The study finds that 69% of first-time BEV buyers received some form of education or training when buying their vehicle. However, when it comes to the specific education topics needed to optimize the ownership experience, the range goes from a high of 46% of first-time buyers who received education on how specific features work to a low of 12% who were provided with education for the total cost to own an EV. “First-time EV buyers are receiving minimal education or training,” said Gruber. “Dealer and manufacturer representatives play the crucial role of front-line educators, but when it comes to EVs, the specific education needed to shorten the learning curve just isn’t happening often enough. The shortfall in buyer education is something we’re seeing with all brands.”

Mass market BEV quality continues to outperform premium BEVs: Owners of mass market BEVs once again experience fewer problems than do owners of premium BEVs, albeit the gap has narrowed this year. Among the top 10 BEV models with the fewest reported problems in the study, seven are in the mass market segment. “In both segments, the two highest-ranked models in the index rankings are also the best-performing models in total quality,” Gruber said. “This illustrates the important link between vehicle quality and overall ownership satisfaction.”

Premium plug-in hybrid electric vehicles (PHEVs) may be a viable alternative: Previous iterations of this study have found that PHEV owners were much less satisfied than BEV owners. However, new for this year is the addition of the premium PHEV segment. Satisfaction among owners in this segment is 741, which is higher than mass market BEVs (725) and mass market PHEVs (632) and only 15 index points lower than satisfaction among owners of premium BEVs. For customers who are hesitant to make the leap to a full EV, a premium PHEV may be a satisfactory alternative.

Public charging woes persist but improvement seen among mass market owners: Although a significant gap in satisfaction regarding public charger availability still exists between premium and mass market BEV owners, it is now narrower than ever before. Among mass market BEV owners, satisfaction is up 86 points year over year (396) as infrastructure buildout continues and brands benefit from the opening of the Tesla Supercharger network. Satisfaction with public charger availability is highest among owners of premium BEVs (551).

BEV owners have strong intent to stick with EVs for next vehicle purchase: Overall, 94% of BEV owners are likely to consider purchasing another BEV for their next vehicle, a rate that is also matched by first-time buyers. Manufacturers should take note of the strong consumer commitment to EVs as the high rate of repurchase intent offers the ability to generate brand loyal customers if the experience is a positive one. In fact, during the past several years, the BEV repurchase intent percentage has fluctuated very little, ranging between 94-97%. This year’s study also finds that only 12% of BEV owners are likely to consider replacing their EV with an internal combustion engine (ICE)-powered vehicle during their next purchase. “With five years of conducting this study and surveying thousands of EV owners, it’s apparent that once consumers enter the EV fold, they’re highly likely to remain committed to the technology,” Gruber said.

Study Rankings

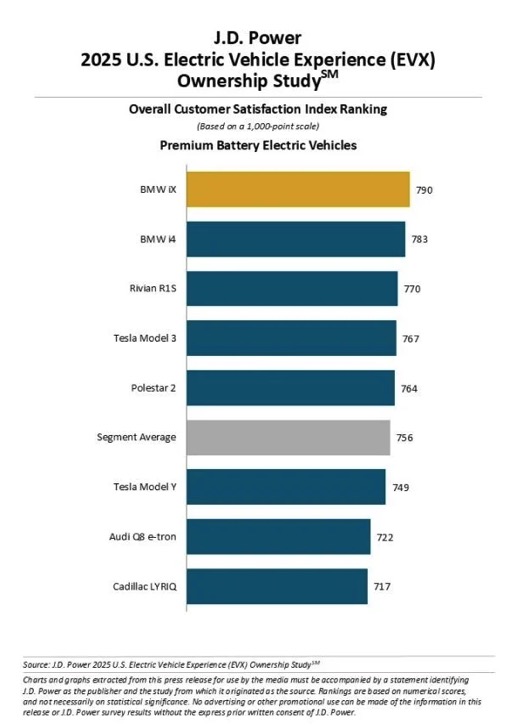

BMW iX ranks highest overall and highest in the premium BEV segment with a score of 790. BMW i4 (783) ranks second and Rivian R1S (770) ranks third.

Hyundai IONIQ 6 ranks highest in the mass market BEV segment with a score of 751. Kia EV6 (743) ranks second and Chevrolet Equinox EV (737) ranks third.

There are eight award-eligible models in the premium segment, which is unchanged from a year ago, and 12 award-eligible models in the mass market segment, down from 14. Satisfaction among owners of premium BEVs averages 756, while satisfaction among owners of mass market BEVs averages 725.

The U.S. Electric Vehicle Experience (EVX) Ownership Study, now in its fifth year, focuses on the crucial first year of ownership. The overall EVX ownership index score measures electric vehicle owner satisfaction in both premium and mass market segments. The 2025 study includes 10 factors (in alphabetical order): accuracy of stated battery range; availability of public charging stations; battery range; cost of ownership; driving enjoyment; ease of charging at home; interior and exterior styling; safety and technology features; service experience; and vehicle quality and reliability.

The study is conducted in collaboration with PlugShare, the leading EV driver app maker and research firm. This study sets the standard for benchmarking satisfaction with the critical attributes that affect the total or overall EV ownership experience for both BEV and PHEV vehicles. Survey respondents include 6,164 owners of 2024 and 2025 model-year BEVs and PHEVs. The study was fielded from August through December 2024.